Financial AI

Top performing hedge fund CIOs and Portfolio Managers use our financial vertical AI suite to generate excess returns via next-generation: systematic shorting exposure for equity hedging, alpha overlays for portfolio optimization, and daily forecasts of changing equity borrow rates.

Systematic Short Exposure

Our Night Vision 100% short hedging system dramatically improves the alpha of short portfolios. Daily tranches of equity exposure generate consistent alpha and are tailored to customer’s specific universe and risk parameters.

- Live since 2017, superior alpha proven throughout all market conditions

- Delivered as a pre-formatted .csv file for simple OMS entry

- Exposure is managed with ~1 min of work per day

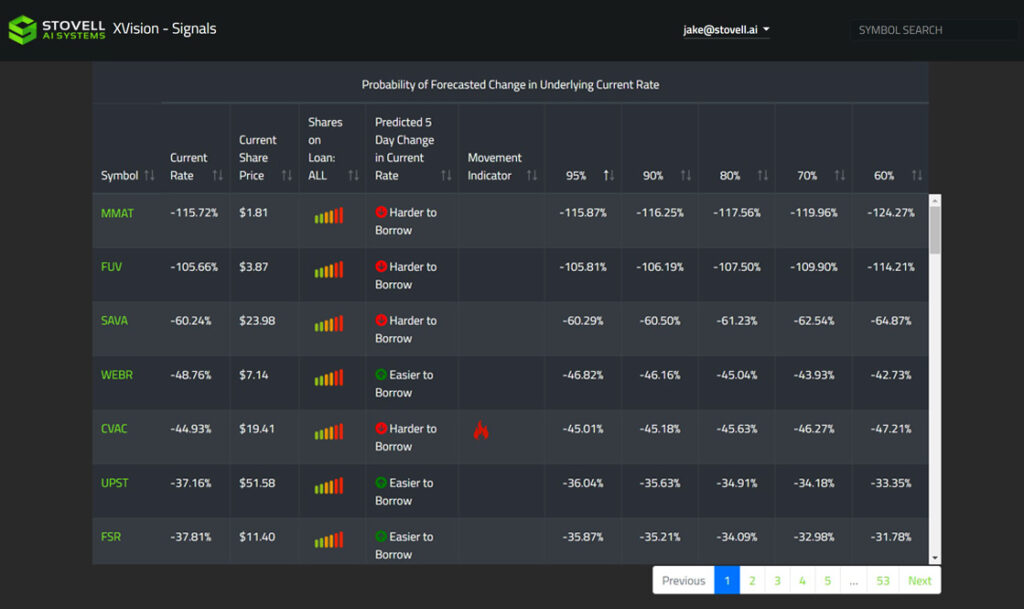

Borrow Rate Forecasting

X Vision Borrow system accurately forecasts changes in the value of equity borrow rates. Borrow desks benefit from increasing market share and profitability of match books.

- Forecasting is optimized for customer’s time frame and use case requirements

- Live signal performance tracked within UI

- Signals delivered via SaaS web interface with zero IT load

Early Bull/Bear Inflections

in Market Trend

Regime Vision AI system predicts rotations and inflection in risk impacting equity portfolios. Portfolio Managers use these insights optimize exposure and generate superior risk adjusted returns.

- Identify most bullish/bearish trends across all portfolios, benchmarks, watchlists, etc.

- Live signal performance tracked within UI

- Signals delivered via SaaS web interface with no IT load required

NIGHT VISION

ALPHA vs. S&P500 hedge

X Vision financial

Regime Vision

ALPHA Live returns since 2019