Advantages

How we achieve superhuman predictive edge

Our Sweet Spot

Our technology excels where high value decisions involving uncertainty must be made by focused teams.

Sweet Spot Characteristics | Description |

|---|---|

- Large scale pricing or investment decisions

- Volatility and variability of current and future marketplace behavior

- Frequent decision making is required

- Focused, high value team executes decision

INDUSTRY | High Value Use Case |

|---|---|

COMMERCIAL MARKETS | Wholesale Fuels Pricing Retail Fuels Pricing Chemicals Pricing |

| |

FINANCIAL | Portfolio Optimization Derivatives Market Making Systematic Equity Short Exposure |

Sweet Spot Characteristics | Description |

|---|

- Large scale pricing or investment decisions

- Volatility and variability of current and future marketplace behavior

- Frequent decision making is required

- Focused, high value team executes decision

INDUSTRY | High Valuez Use CasE |

|---|

Commercial Markets

- Wholesale Fuels Pricing

- Retail Fuels Pricing

- Chemicals Pricing

Financial

- Portfolio Optimization

- Derivatives Market Making

- Systematic Equity Short Exposure

What Makes Us Different

We Enable Our Customers to Win at Scale With Our AI

Stovell AI Systems | Typical AI Platforms | |

|---|---|---|

AI MISSION |

|

|

USER EXPERIENCE |

|

|

SYSTEM PACKAGING |

|

|

AI PREDICTIVE CAPABILITIES |

|

|

LIVE SYSTEMS |

|

|

Stovell AI Systems | Typical AI Platforms | ||

|---|---|---|---|

AI MISSION | AI MISSION | ||

|

| ||

| |||

Stovell AI Systems | Typical AI Platforms | ||

USER EXPERIENCE | USER EXPERIENCE | ||

|

| ||

| |||

Stovell AI Systems | Typical AI Platforms | ||

SYSTEM PACKAGING | SYSTEM PACKAGING | ||

|

| ||

| |||

Stovell AI Systems | Typical AI Platforms | ||

AI PREDICTIVE CAPABILITIES | AI PREDICTIVE CAPABILITIES | ||

|

| ||

| |||

Stovell AI Systems | Typical AI Platforms | ||

LIVE SYSTEMS | LIVE SYSTEMS | ||

|

| ||

ENERGY USE CASES

Market Vision Retail

Predict Key Competitors – Accurately predict when key competitors in the market are going to change their street price 1 to 3 days in advance.

Avoid Driving Market Down – Knowing when competitors are going to move their price; teams can avoid margin and volume destructive events.

Advantageous Market Followership – Accurately predict when competitors will follow your pricing change.

Predict Key Competitors – Accurately predict when key competitors in the market are going to change their street price 1 to 3 days in advance.

Avoid Driving Market Down – Knowing when competitors are going to move their price; teams can avoid margin and volume destructive events.

Advantageous Market Followership – Accurately predict when competitors will follow your pricing change.

Market Vision Wholesale

Lower Pricing Volatility – accurately price to your organization’s existing pricing strategies.

Avoid Leaving Money on Table – systematically price to your strategy, ensure your team is not pricing below strategies.

Execute Enhanced Pricing Strategies – with systematic accuracy of Market Vision, teams can test and implement more advanced strategies.

Lower Pricing Volatility – accurately price to your organization’s existing pricing strategies.

Avoid Leaving Money on Table – systematically price to your strategy, ensure your team is not pricing below strategies.

Execute Enhanced Pricing Strategies – with systematic accuracy of Market Vision, teams can test and implement more advanced strategies.

Elasticity Vision Wholesale

Need to Move Inventory – predict which terminals can move high amounts of incremental volume with a lower price.

Need to Optimize Margin – predict which terminals will not have a volumetric penalty with a higher price.

Expand RUL-PUL Spreads – predict intermediate periods of time to increase spreads between product grades to increase fuel margin.

Need to Move Inventory – predict which terminals can move high amounts of incremental volume with a lower price.

Need to Optimize Margin – predict which terminals will not have a volumetric penalty with a higher price.

Expand RUL-PUL Spreads – predict intermediate periods of time to increase spreads between product grades to increase fuel margin.

Demand Vision Wholesale

Daily Volume Spikes – accurately predict high and low volume days, enabling pricing team to adjust pricing to optimize fuel margin.

Weekly Volume Spikes – accurately predict high and low volume weeks, allowing pricing team to execute advantageous pricing strategies.

Daily Volume Hedging – accurate prediction lowers the organization’s annual hedging costs.

Daily Volume Spikes – accurately predict high and low volume days, enabling pricing team to adjust pricing to optimize fuel margin.

Weekly Volume Spikes – accurately predict high and low volume weeks, allowing pricing team to execute advantageous pricing strategies.

Daily Volume Hedging – accurate prediction lowers the organization’s annual hedging costs.

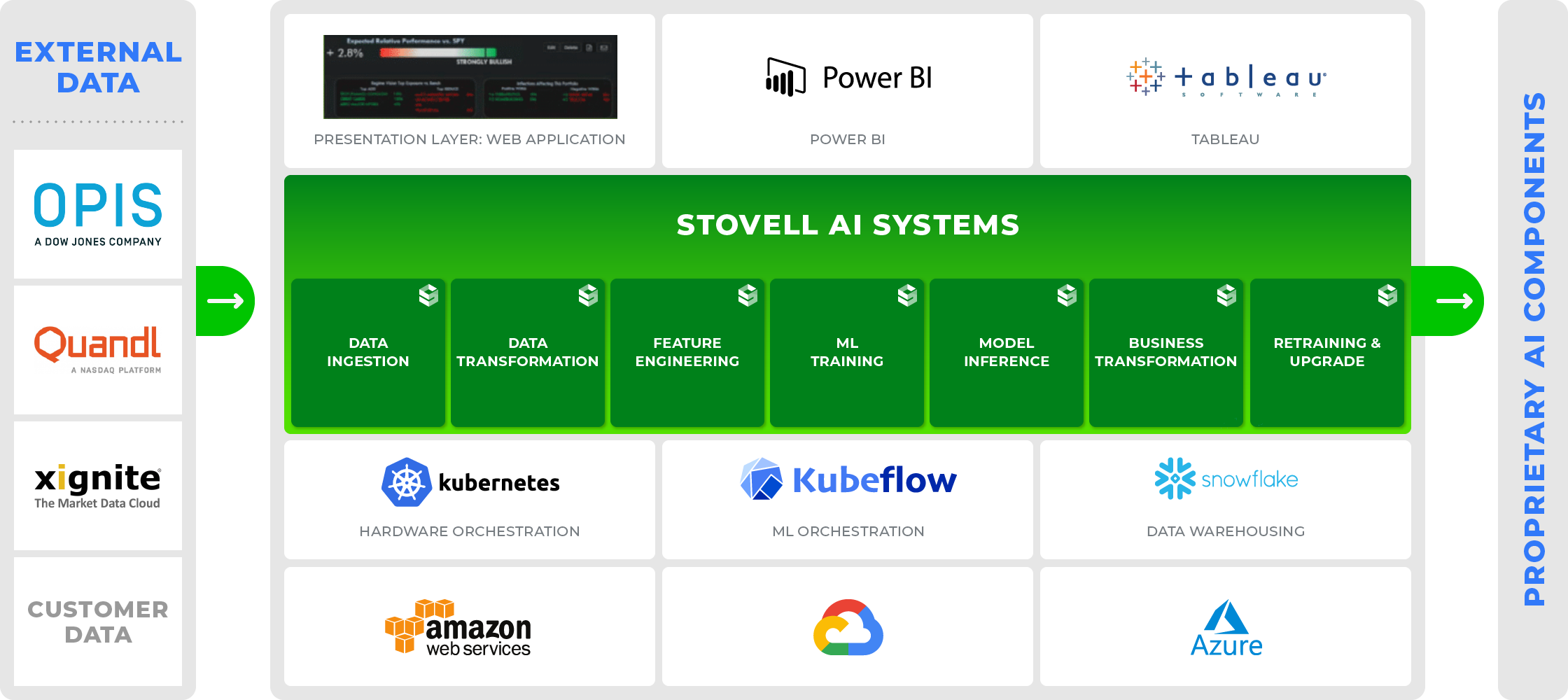

Our Superior Technology Drives Profit Generation at Scale

- Proprietary suite of AI Components → focused on high accuracy marketplace signals

- State of the Art Tech Stack → enabling global enterprise scale, robustness, security

- Track Record of Success → predictive edge delivered directly to high-value decision makers

Stovell AI Systems Engineering Platform